What is TPD insurance?

If you’re injured or become ill and it’s impossible for you to return to work, TPD insurance is immensely helpful as it provides you with a financial safety net.

TPD stands for total and permanent disability. It is essentially an insurance policy that pays out a lump sum if you become totally and permanently disabled because of illness or injury.

You can buy TPD insurance from:

- Superannuation fund

- Direct insurer

- Employment contract

Each insurer defines what being totally and permanently disabled means. Before taking a TPD cover, check with your insurer about their definition.

Every insurer provides a TPD insurance quote for brief information on what is and isn’t covered.

What conditions fall under brain disorders?

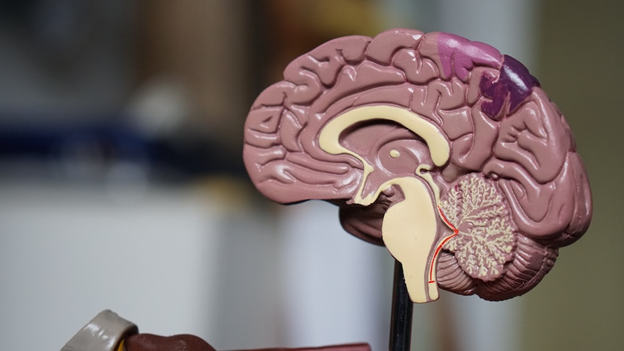

The brain is a perplexing organ that controls every aspect of our lives, from how we think, feel and interact with others to what we see, hear and smell. Brain disorders and conditions can be highly complicated and challenging to treat.

It doesn’t come as a surprise that brain disorders and conditions have an entire spectrum of symptoms and experiences like:

- Meningitis

- Stroke

- Brain tumour

- Dementia

- Foetal Alcohol Spectrum Disorder (FAS-D)

Brain disorders and conditions can include injuries such as a fractured skull or concussion, degenerative diseases, and illnesses. Some of these conditions can be treated with medication or surgery, while others may require lifelong care.

As is the case with any medical issue, brain disorders and conditions affect everyone differently, varying in complexity, severity, and duration. You can check out details on TPD, online, for quick information.

TPD and Brain disorders

TPD is not confined to people who’ve suffered an amputation or are confined to wheelchairs. On the contrary, it applies to any illness or injury that prevents you from working. These include permanent work injuries like back or shoulder injuries, cancer, degenerative diseases, chronic pain, mental illness, and acquired brain injuries/disorders.

If you’ve been diagnosed with a brain injury, it’s vital to ensure that you understand whether your superannuation fund will pay out a TPD benefit or not.

If you cannot work due to disorders or injuries, you may be eligible for TPD benefits.

TPD is a No-Fault Insurance, which implies that you don’t need to prove fault by anyone to succeed in making a claim.

That being said, you’re required to prove that you meet your insurer’s eligibility criteria for TPD.

To make a successful TPD claim for brain disorders:

- You need to ensure you have TPD insurance and that it has been renewed.

- You also need to get proper medical treatment and evidence of your injury or illness so that it’s deemed legitimate when your claim is assessed.

- Your insurer will assess your TPD claim for brain disorder based on its criteria and may need you to complete a statement form from each employer where you’ve worked in the last five years.

Summing it up

TPD insurance covers any kind of disability that leaves you unfit to work for your job.

To avoid your insurer rejecting your claim, do ensure that you’ve met the conditions for brain illness and disorders. It’s better to take professional help if you’re not quite aware of the policy you’ve taken.